Many property owners and investors in Atlanta opt for a DIY approach. They believe it's a cost-effective way to manage their properties.

However, the real cost of DIY property management can be deceiving. Hidden expenses and time investments often outweigh the perceived savings.

Understanding DIY Property Management Costs

Managing a property seems straightforward at first glance. Many investors decide to take the DIY path. They anticipate saving on management fees.

However, DIY property management often involves unforeseen costs. These hidden expenses can catch property owners off guard. To truly understand DIY property management costs, consider the following factors:

- Maintenance and repair costs due to emergency responses.

- Potential income lost during periods of vacancy.

- Legal fees related to tenant disputes or evictions.

- Marketing expenditures for advertising rental availability.

- Accounting and bookkeeping time expenses.

Each of these factors can impact your bottom line. Maintenance issues can escalate without professional oversight. Leaking faucets can become costly plumbing nightmares.

Moreover, DIY landlords can face challenges in legal compliance. Navigating local rental laws can be complex and time-consuming. Missteps can result in costly fines or penalties.

DIY management might impact tenant relations as well. Inconsistent service or response delays can lead to tenant dissatisfaction. This can result in higher turnover rates and further financial losses.

The Hidden Expenses of DIY Management

Beyond the obvious costs, there are several hidden expenses. Many DIY landlords overlook these during budgeting.

For instance, insurance premiums might increase if risks are perceived as higher. Without professional oversight, tenants can cause hidden damages.

Professional property managers often secure better contractor rates. DIY landlords might pay more due to inexperience in negotiation. This can inflate repair and maintenance expenses.

Legal repercussions present another potential hidden cost. DIY managers might mishandle eviction processes or lease terms. Legal fees and compensation can rapidly accumulate.

Vacancies due to inefficient marketing can deplete potential income. Professionals possess marketing skills to attract quality tenants promptly.

Finally, burnout is another hidden cost. Juggling multiple responsibilities can reduce focus on investment growth. Stress and exhaustion can ultimately lead to suboptimal decision-making.

Time: The Overlooked Investment

Time is a critical yet often overlooked factor. Managing a property demands significant time investment.

From tenant screening to maintenance coordination, tasks are time-consuming. DIY landlords spend hours managing these aspects regularly. This time could otherwise be used for growing investments or personal pursuits.

Tenant relationships require consistent attention. Responding promptly to requests enhances satisfaction and retention. However, this might require landlords to be available 24/7.

Tracking finances and staying compliant with regulations demands further time. Many DIY landlords underestimate the ongoing time commitment required.

Effective marketing strategies also need dedicated time and effort. Crafting listings and managing inquiries can be a daunting task. Without expertise, achieving desired results may take longer.

In essence, time is as valuable as financial resources. When you're investing your time into management, it translates to missed opportunities elsewhere. The reduction in leisure and business growth time can affect both income and lifestyle.

The Value of Professional Atlanta Property Managers

Hiring a professional property manager offers multiple advantages. These experts bring experience and resources to the table. They manage properties efficiently, boosting profitability and reducing stress.

First, they understand local rental market dynamics. This insight allows them to set competitive rental rates. Investors benefit from optimized rental income without guesswork.

Next, professional managers have established processes. They streamline rent collection, ensuring timely payments. Owners enjoy consistent cash flow, which is key for financial planning.

These professionals also handle marketing and tenant screening. They use proven methods to attract and retain quality tenants. This results in fewer vacancies and reduced turnover.

Property managers maintain strong networks with contractors. This relationship secures reliable and cost-effective maintenance services. Prompt repairs preserve property value and tenant satisfaction.

Additionally, they provide detailed financial reports. These help property owners understand their investment performance. Such transparency aids informed decision-making.

Lastly, they offer peace of mind through risk management. Professional managers are adept at navigating insurance and liability concerns. They minimize risks while maximizing property profitability.

Compliance with Local Laws and Regulations

Navigating local laws is tricky for many property owners. Atlanta property managers are well-versed in these legalities. They ensure compliance, reducing the risk of costly fines.

Local regulations can frequently change. Property managers stay current with these updates. Their expertise protects owners from inadvertent violations.

Managers also oversee correct lease agreements. They ensure all terms align with regional legal standards. This reduces disputes and enhances tenant trust.

Tenant disputes often arise over misunderstandings of rights. Professional managers mediate effectively, resolving issues promptly. This keeps relationships amicable and avoids legal escalations.

Moreover, they handle eviction processes swiftly and correctly. This expertise minimizes the chances of legal confrontations. Property owners can focus on growing their investments with fewer worries about compliance.

Enhancing Tenant Satisfaction and Retention

Tenant satisfaction directly impacts retention rates. Happy tenants are more likely to renew their leases. Atlanta property managers prioritize enhancing tenant experiences.

Prompt response to maintenance requests is crucial. Managers coordinate repairs swiftly, maintaining tenant happiness. Satisfied tenants are more likely to care for the property.

Professional managers foster open communication channels. Tenants feel valued and heard, which enhances their experience. This rapport fosters a sense of community and loyalty.

Additionally, property managers implement tenant retention programs. These initiatives can include small incentives or community events. Such efforts build goodwill and encourage lease renewals.

Understanding tenant needs also guides property improvements. Managers advise on enhancements that increase tenant satisfaction. Tailoring properties to tenant preferences boosts retention rates.

Ultimately, a focus on tenant satisfaction elevates property success. Content tenants mean fewer vacancies and steady rental income. This is a win-win scenario for property owners aiming to maximize returns.

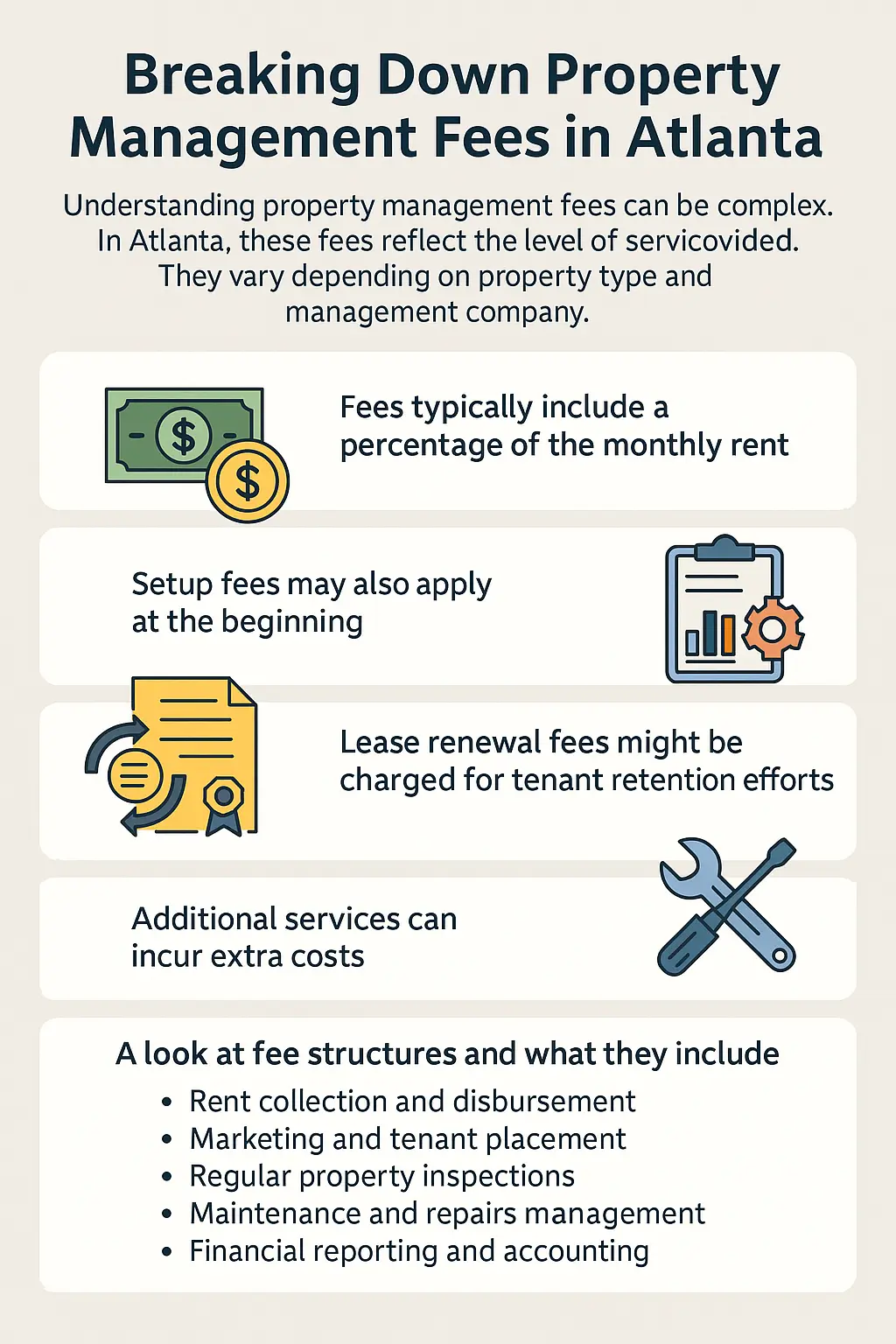

Breaking Down Property Management Fees in Atlanta

Understanding property management fees can be complex. In Atlanta, these fees reflect the level of service provided. They vary depending on property type and management company.

Fees typically include a percentage of the monthly rent. This covers essential services like rent collection and tenant communication. It ensures the manager’s interests align with maximizing rental income.

Setup fees may also apply at the beginning. These cover the initial setup of accounting and marketing systems. Transparency with these fees helps investors budget effectively.

Lease renewal fees might be charged for tenant retention efforts. They recognize the manager's role in maintaining tenant satisfaction. Retained tenants reduce costly turnover and vacancy times.

Additional services can incur extra costs. These might include emergency maintenance or detailed financial reporting. Property owners should discuss these fees to avoid surprises.

Here's a brief look at what fees may cover:

- Rent collection and disbursement

- Marketing and tenant placement

- Regular property inspections

- Maintenance and repairs management

- Financial reporting and accounting

- Tenant relationship management

A Look at Fee Structures and What They Include

Fee structures vary across Atlanta property management companies. Most firms charge a percentage of rent collected, typically around 8-12%. This incentivizes maximizing rental income for both parties.

Some companies employ flat fee models. These models charge a set amount per unit managed. While simpler, this gives the manager no incentive to get you the maximum amount of rent.

Setup fees are another component. These initial fees cover administration tasks like marketing and tenant sourcing. It's crucial to understand these costs upfront.

Renewal fees are common with lease extensions. They compensate for efforts in retaining tenants. A successful renewal avoids the costs of turnover.

Maintenance fees could be separate or included in the invoice amount. Clarifying what each fee covers prevents misunderstandings. Transparency here helps form a solid budget strategy.

How Management Fees Translate to Profitability

Management fees might seem like a cost, but they often lead to higher profits. This paradox lies in the efficiency and expertise of professional managers. They improve operations and boost rental income.

Efficiency is key to reducing unnecessary costs. Property managers streamline processes, cutting time wastage. They ensure minimal vacancies by expertly marketing properties.

Experts help in setting competitive rental rates. They leverage market knowledge to avoid underpricing. This maximizes income while maintaining tenant demand.

Managers offer comprehensive financial reporting. Clear insights into expenses and income inform strategic decisions. This clarity aids in optimizing returns and planning future investments.

Lastly, property managers reduce legal risks. Their expertise ensures compliance with laws, avoiding fines. This legal assurance preserves profits by preventing costly disputes.

Ultimately, investing in management services can yield higher returns. The balance between fees paid and benefits received skews positively. This makes property management a wise choice for long-term profitability.

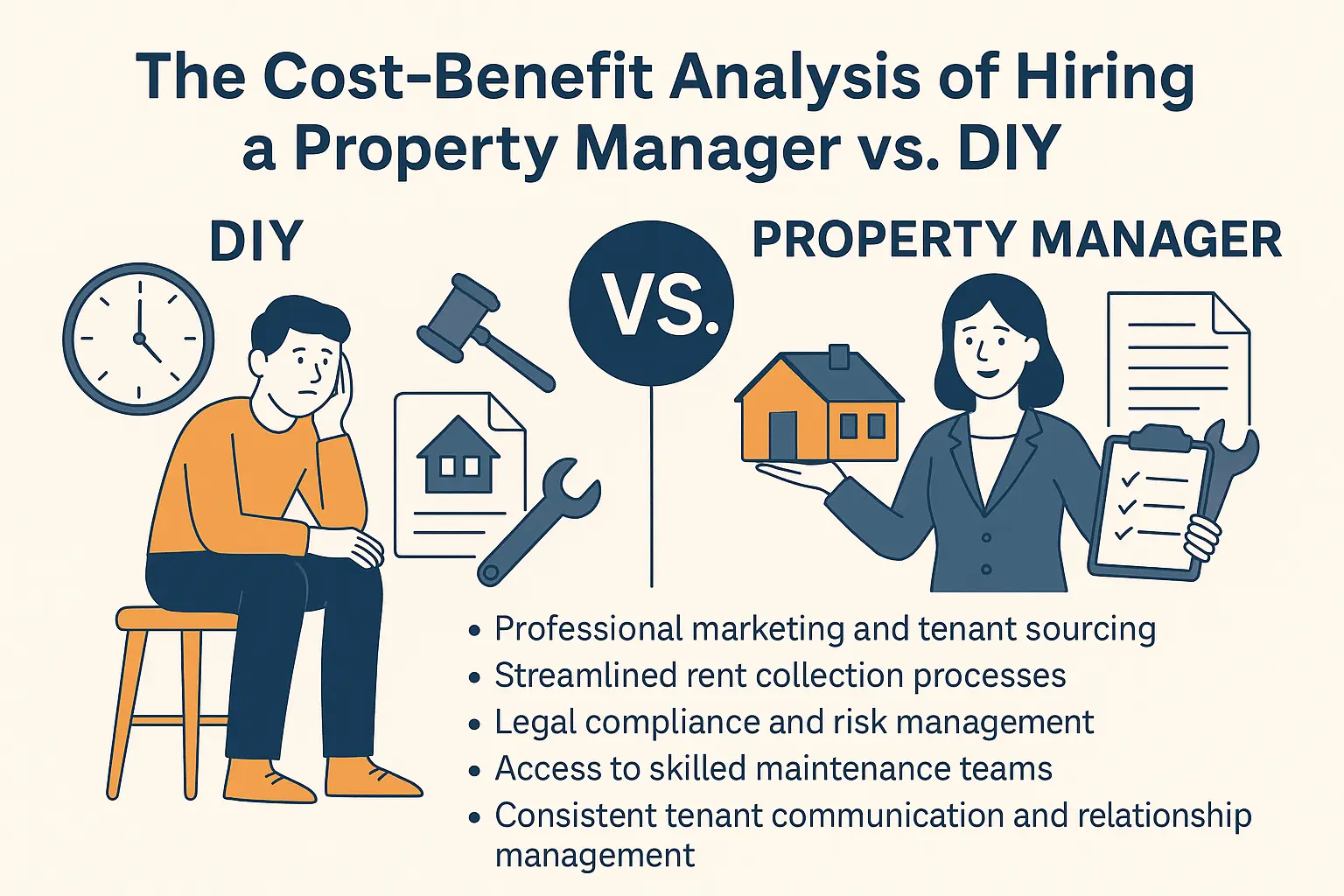

The Cost-Benefit Analysis of Hiring a Property Manager vs. DIY

Choosing between DIY management and hiring a property manager involves weighing costs against benefits. On the surface, DIY might seem cheaper due to no direct management fees. However, hidden costs like time investment and potential legal issues loom large.

Professional property managers bring efficiency and expertise. They manage tenant relationships, ensuring timely rent collection and reduced vacancies. The peace of mind alone can justify their fees for many investors.

Consider the skill of setting the right rental price. Managers use market data to maximize income without driving tenants away. This expertise can significantly boost profits.

Then, think about managing repairs and maintenance. Property managers have a network of reliable contractors for cost-effective solutions. DIY attempts can often be costlier in both money and time.

A key list of benefits from hiring property managers might include:

- Professional marketing and tenant sourcing

- Streamlined rent collection processes

- Legal compliance and risk management

- Access to skilled maintenance teams

- Consistent tenant communication and relationship management

Professional management also allows you to focus on other investments. This could enhance your entire portfolio’s growth, offering a considerable advantage over DIY methods.

Long-Term Financial Implications

Investors often overlook long-term financial impacts of their management choices. DIY may initially appear cost-saving but demands significant personal time. This time spent is time lost from other income-generating activities or investments.

Professionals bring essential experience in pricing and rent collection. Correct pricing strategies ensure steady cash flow and competitive edge. Consistent rent payments maintain investor’s financial projections.

Costly mistakes can arise from legal missteps. DIY managers face liability risks from ignorance of property laws. Professional oversight mitigates these risks, safeguarding against fines and penalties.

Recurring tenant turnovers incur costs, such as cleaning, repairs, and vacancy losses. Professional managers excel in tenant retention, minimizing these expenses. Their expertise aids in selecting reliable tenants, lessening evictions and payment issues.

Ultimately, professional management increases stability and profitability. Their services, while initially a cost, create a more valuable investment. Over time, this leads to higher returns and less stress.

Scalability and Growth with Professional Management

Investors aiming for portfolio growth find professional management indispensable. Scaling properties involves complexities DIY management rarely handles effectively. Property managers streamline many processes essential for scalability.

Managing multiple properties extends beyond daily task multiplication. Managers bring systematic approaches to rent collection and tenant communication. They ensure consistency across properties, crucial for growth.

Access to market insights helps set competitive, yet profitable, rental rates. Managers adapt quickly to market changes, maintaining investor competitiveness. DIY managers often lack the resources and data for these rapid adjustments.

Expansion demands a stable tenant base. Professional managers design retention programs to maintain high occupancy. This stable foundation supports further investments and decreases turnover costs.

Finally, property managers provide detailed reporting and analysis. Investors gain insights into revenue trends, operational efficiencies, and property health. Such transparency aids strategic planning for future acquisitions or improvements.

Professional management allows investors to focus on growth strategies, ensuring a promising return on their expanding portfolio.

Conclusion: Making the Smart Choice for Your Investment

Deciding how to manage your properties can profoundly affect your financial success. Weighing the costs and benefits is crucial, and finding the right approach is vital. Atlanta property managers offer value through their expertise and efficiency, mitigating the challenges and costs of DIY management.

With professional guidance, compliance and tenant satisfaction become less burdensome. These managers can optimize your investment returns while reducing stress and saving you time. This allows investors to focus on growth.

Ultimately, the choice between DIY and hiring a property manager hinges on long-term goals. The advantages of professional management often lead to greater profitability and a more streamlined ownership experience.